If your business is in the building and construction industry you are quickly running out of time to get your Taxable payments annual report lodged!

If your business is in the building and construction industry you are quickly running out of time to get your Taxable payments annual report lodged!

Most entrepreneurs share a natural optimism with a belief that things will turn out for the best – but this can seriously hold them back when it comes to asking for help. Have you fallen into the trap of feeling you have to ‘cope’, ‘just do it’, ‘go it alone’ or any of the other phrases we associate with the heroic business person prevailing despite all obstacles? Could it be

22

Aug 2017

Why is the balance sheet important?

Most small businesses look at the Profit and Loss Statement regularly, but many don’t understand the importance of the balance sheet. What is a balance sheet? A business’ balance sheet is a detailed list of its assets, liabilities (or money owed by the business), and the value of the shareholders’ equity (or net worth of the business) at a specific point in time. Assets are anything of value owned by

Bookkeepers aren’t glorified data entry people – and paying them accordingly risks missing out on insights which can take your business to the next level. Bookkeeper Kelly Berger runs a successful bookkeeping business. She also started Bookkeepers Support Group Australia, a space where bookkeepers gather to discuss developments in their industry and generally shoot the breeze. She told The Pulse that one of the themes running through the industry at the moment is the rise

Management trends can come and go, and a few can even re-emerge after lying in wait. One idea to re-emerge in recent times is that the buck needs to stop somewhere. Slowly, organisations have started to re-invent the concept of accountability. Accountability is back on the agenda The value of employees having autonomy, mastery and purpose to their work has been a popular idea, as has been aligning employees on a central ‘why’. The result

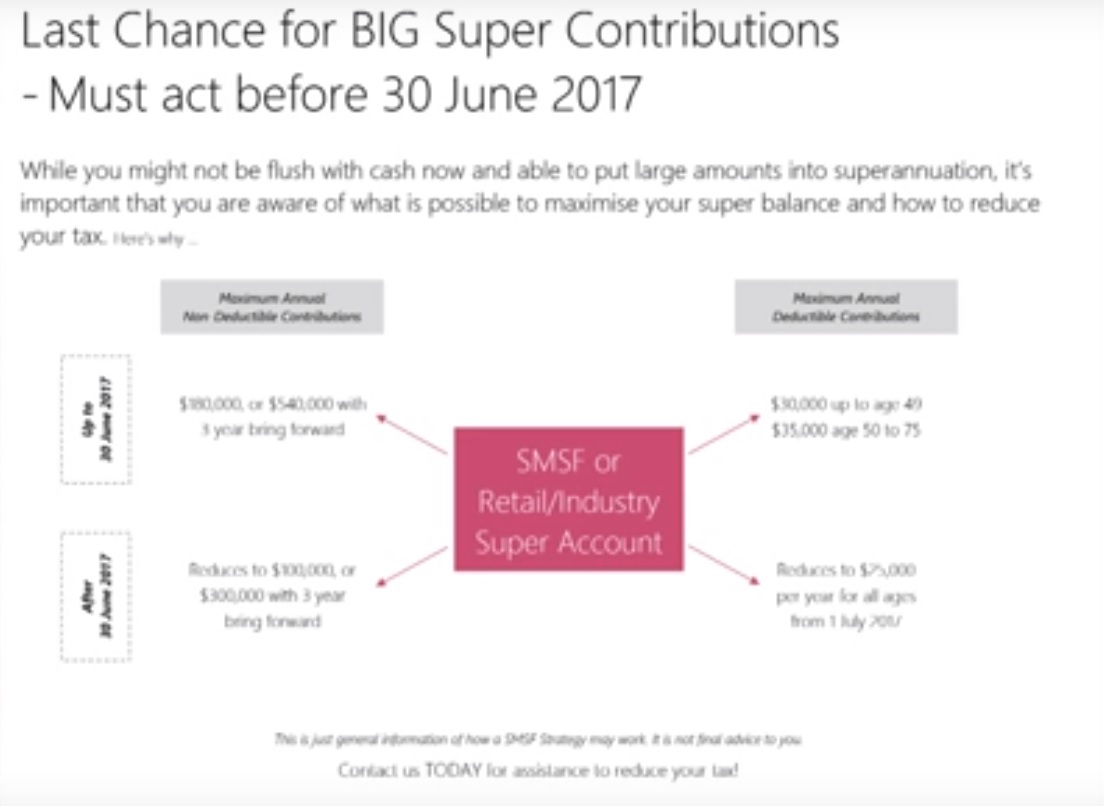

Radical and substantial superannuation changes take effect from 1 July 2017, meaning time is running out to make the most of this very effective tax minimisation strategy.

With small businesses facing unprecedented economic uncertainty in the US and UK, you might expect their general outlook to veer toward the pessimistic. Yet, our research into the opinions and sentiments of small business owners and their accountants showed something entirely different. The results of our second annual Make or Break Report revealed an irrepressible and unexpected optimism. Both owners (79%) and accountants (84%) feel more confident about 2017 than

08

Mar 2017

Your health = the health of your business

There’s a direct correlation between happiness and healthiness in workers and productivity. The same is true for businesses. In Xero’s 2017 second annual Make or Break report, research revealed that 78% of small business owners believed their personal well-being (as well as that of their employees) is inextricably linked to the health of their business. As a result, they make their health and happiness a top priority. Health and your business

08

Mar 2017

PPSA claims another victim – a $23 million asset is lost to the insolvent Onesteel Group

All businesses should be aware of the importance of properly recording security interests on the Personal Property Securities Register (PPS Register). The courts have once again reminded us of the importance of strict compliance with the legislation when registering security interests, and the potential to lose property to third parties when registrations are inadequate in the event of external administration. In the matter of OneSteel Manufacturing Pty Limited (administrators appointed)