27

Apr 2018

FREE Guides TO REDUCE Your TAX

TAX PLANNING Tax planning is an important activity that should be done throughout the year, to not only ensure that you are aware of (and prepared for) your financial obligations, or if you need a business loan warrenton mo for next year, but also to ensure that you are not paying any more tax than you have to! How you ever stopped to think about what you could do with

27

Apr 2018

FREE Guides TO REDUCE Your TAX

TAX PLANNING Tax planning is an important activity that should be done throughout the year, to not only ensure that you are aware of (and prepared for) your financial obligations, or if you need a business loan warrenton mo for next year, but also to ensure that you are not paying any more tax than you have to! How you ever stopped to think about what you could do with

27

Apr 2018

FREE Guides TO REDUCE Your TAX

TAX PLANNING Tax planning is an important activity that should be done throughout the year, to not only ensure that you are aware of (and prepared for) your financial obligations, or if you need a business loan warrenton mo for next year, but also to ensure that you are not paying any more tax than you have to! How you ever stopped to think about what you could do with

In one of the most dramatic changes to property depreciation legislation in more than 15 years, Parliament has passed the Treasury Laws Amendment (Housing Tax Integrity) Bill 2017 as at Wednesday 15th November 2017 and the Bill is now legislation.

In one of the most dramatic changes to property depreciation legislation in more than 15 years, Parliament has passed the Treasury Laws Amendment (Housing Tax Integrity) Bill 2017 as at Wednesday 15th November 2017 and the Bill is now legislation.

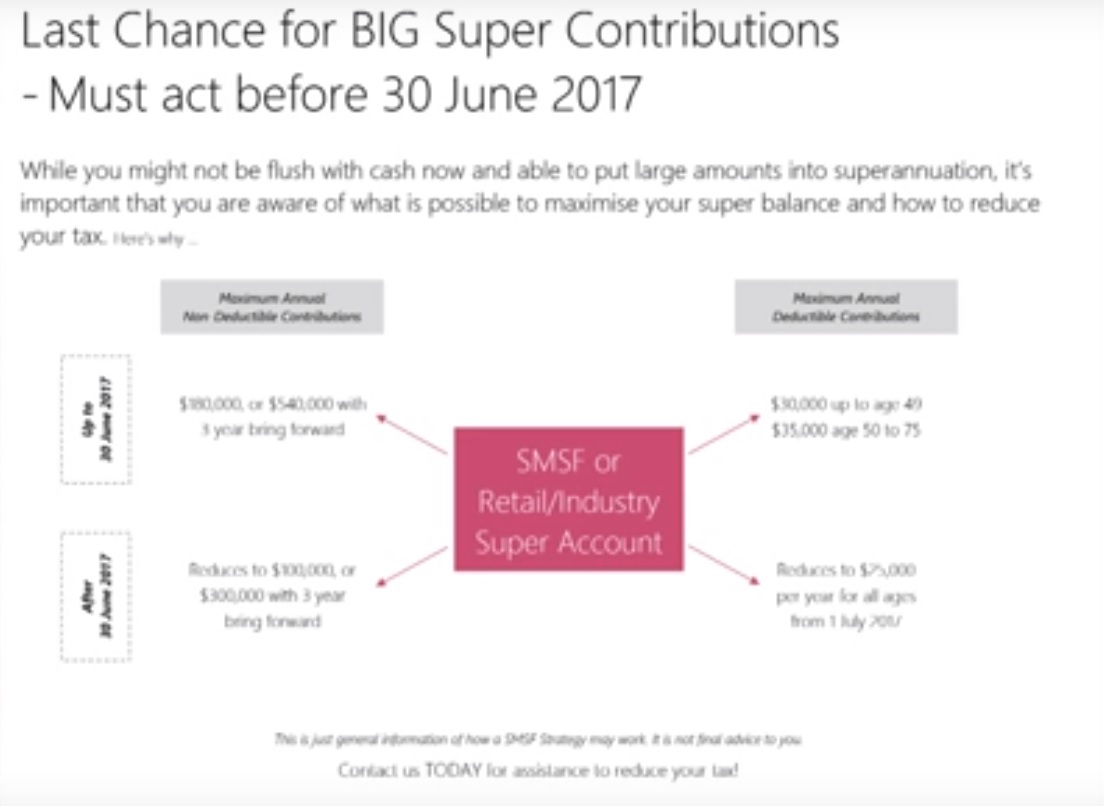

Radical and substantial superannuation changes take effect from 1 July 2017, meaning time is running out to make the most of this very effective tax minimisation strategy.

Radical and substantial superannuation changes take effect from 1 July 2017, meaning time is running out to make the most of this very effective tax minimisation strategy.

12

May 2017

2017-2018 Federal Budget Update

The Treasurer has presented the Federal Budget proposals for 2017 to Parliament, and the Business Wise team have been busy breaking it down. In this article are the key changes that we feel may affect a large number of our clients.

How are we planning to use taxes this year? The citizens have a right to a straight answer to this question. Thankfully, we have a plan that we wish to breakdown here today. The most important part of our tax allocation for the year comes in the form of constructions to benefit the city. A few new apartment and housing complexes are to be built, so we will need to

Australian startups are being urged to review their claims for research and development tax offsets, following a joint alert from the Australian Taxation Office and the Department of Industry, Innovation and Science about claims for software development projects. The warning relates to concerns about the eligibility of activities that some companies are making claims for under the Research and Development (R&D) Tax Incentive scheme. According to the ATO, examples of ineligible